31 Jul 2025

The Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS) are pivotal global frameworks governing tax information reporting for financial institutions. For fund’s management team operating internationally, navigating these mandates is fundamental to ongoing operations and investor confidence. Failure to comply can lead to significant financial penalties, reputational damage, and prolonged regulatory scrutiny, extending well beyond the initial penalty phase.

This checklist outlines the essential steps fund’s management team need to follow to establish and maintain a robust FATCA/CRS compliance program, minimizing risk exposure and ensuring adherence.

Why Funds Face Higher Compliance Risks

Non-compliance triggers:

• Withholding Penalties: 30% on U.S.-sourced income (FATCA)

• Reputational Fallout: LP withdrawal, fundraising hurdles

• Audit Domino Effect: Multi-jurisdictional scrutiny of SPVs and feeder funds

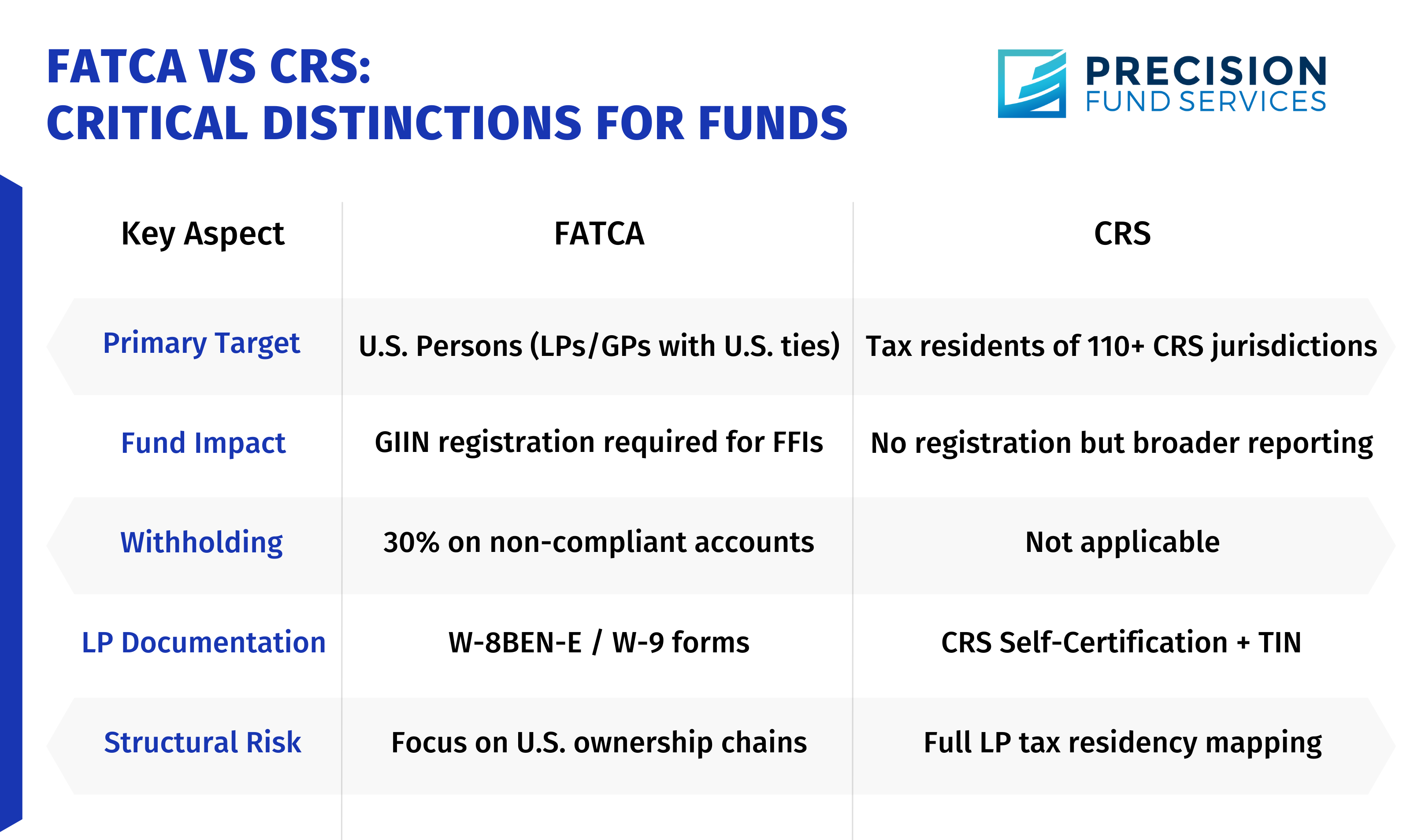

Core Distinctions: FATCA vs. CRS

• FATCA (U.S. Focus): Enacted in 2010, FATCA targets U.S. tax evasion by requiring foreign financial institutions to report information about accounts held by U.S. persons to the IRS. Non-compliant payments may face 30% withholding on U.S.-sourced income and only if the FFI is non-compliant or the account holder is recalcitrant.

• CRS (Global Focus): Developed by the OECD, CRS facilitates the automatic exchange of financial account information between tax authorities in over 100 participating jurisdictions. Its scope is broader than FATCA, targeting tax residents of reportable jurisdictions.

10-Step FATCA/CRS Compliance Checklist for Fund’s management team

To maintain compliance, fund’s management team require a standardized, end-to-end approach. This 10-point checklist serves as a guide:

1. Entity Classification

Fund’s management team must accurately determine their own classification and that of their underlying investors/entities based on the relevant definitions. This classification dictates specific due diligence and reporting obligations.

• FATCA: Focuses on Foreign Financial Institutions (FFIs) and Non-Financial Foreign Entities (NFFEs).

• CRS: Focuses on Financial Institutions (FIs) and Non-Financial Entities (NFEs - further categorized as Active or Passive). Crucially, Passive NFEs require identifying their Controlling Persons base on each of the jurisdiction’s requirement, e.g. BVI and Cayman: Apply 10% threshold and Hong Kong: Retains 25%

Fund’s management team should be aware that local jurisdictions may issue specific classification rules or guidance. For example, Under CRS, a Passive NFE must disclose its Controlling Persons if any are Reportable Persons. However, in BVI and Cayman Islands, even if a Passive NFE is owned through an intermediate entity that is a Reporting Financial Institution, fund managers must still look through that entity if the intermediate entity is not a Participating Jurisdiction FI or not subject to CRS reporting. This requirement ensures transparency in ownership chains involving jurisdictions that do not participate in CRS exchanges. Therefore, always verify alignment with the relevant tax authority's standards.

2. Registration and GIIN Acquisition (FATCA-specific)

If classified as an FFI under FATCA, fund’s management team must register with the IRS via the FATCA portal to obtain a Global Intermediary Identification Number (GIIN). GIIN registration is required for FFIs under FATCA, regardless of whether the jurisdiction follows Model 1 (e.g., Cayman, BVI) or Model 2 (e.g., Hong Kong).

The GIIN (a 19-character number) is vital for:

• IRS reporting identification

• Inclusion on the IRS FFI list

• Demonstrating compliance to withholding agents.

Fund’s management team must ensure their registration details (contact info, classification) are kept current within the IRS portal.

3. Investor Due Diligence (IDD)

Robust procedures are essential to identify the tax residency and/or U.S. status of investors during onboarding and throughout the lifecycle of the investment. Onboarding processes must integrate FATCA/CRS requirements.

Key Tools: Collect and validate relevant self-certification forms:

• FATCA: Form W-9 (U.S. persons), W-8BEN-E/ W-8BEN (non-U.S. entities/persons)

• CRS: Jurisdiction-specific self-certification forms (containing tax residency and TIN details) for example, Hong Kong IRD provides a standard template, while BVI and Cayman allow customized formats as long as required data is captured.

Scrutinize for Indicia:

• FATCA: U.S. birthplace, citizenship/residency, address/phone, standing instructions to U.S. accounts.

• CRS: Indicators of tax residency in reportable jurisdictions.

Validate Reasonableness: Compare self-certifications against fund KYC/AML data. Inconsistencies require updated documentation or may lead to classifying the account as reportable.

4. Data Collection and Maintenance

Accurate and comprehensive data capture, storage, and updating are critical for classification, due diligence, and reporting. Key data points include TINs, GIINs, account balances, full holder details, and entity classifications.

• Fund’s management team need systems capable of: Periodic data reviews, flagging incomplete/invalid information, and securely updating records.

• Leverage Technology: Utilizing integrated systems or specialized tools can significantly reduce manual errors in data handling.

5. Reporting Obligations

In the event reporting is required to be submit, the Fund’s management team must submit annual reports containing specified information about reportable accounts.

• FATCA Reporting: For jurisdictions under a Model 2 IGA, such as Hong Kong, reporting is submitted directly to the IRS, but financial institutions must also register with the IRD. For Model 1 IGA jurisdictions, such as Cayman Islands and BVI, FATCA reports are submitted to the local tax authority—the DITC in Cayman and the ITA in BVI—which then transmits the data to the IRS.

• CRS Reporting: To the local tax authority for international exchange which then transmits data via the OECD’s CTS via the OECD's Common Transmission System (CTS).

• Critical: Reports must adhere to the precise FATCA and CRS XML schemas. Format errors risk rejection and penalties. Retain copies of reports and submission confirmations.

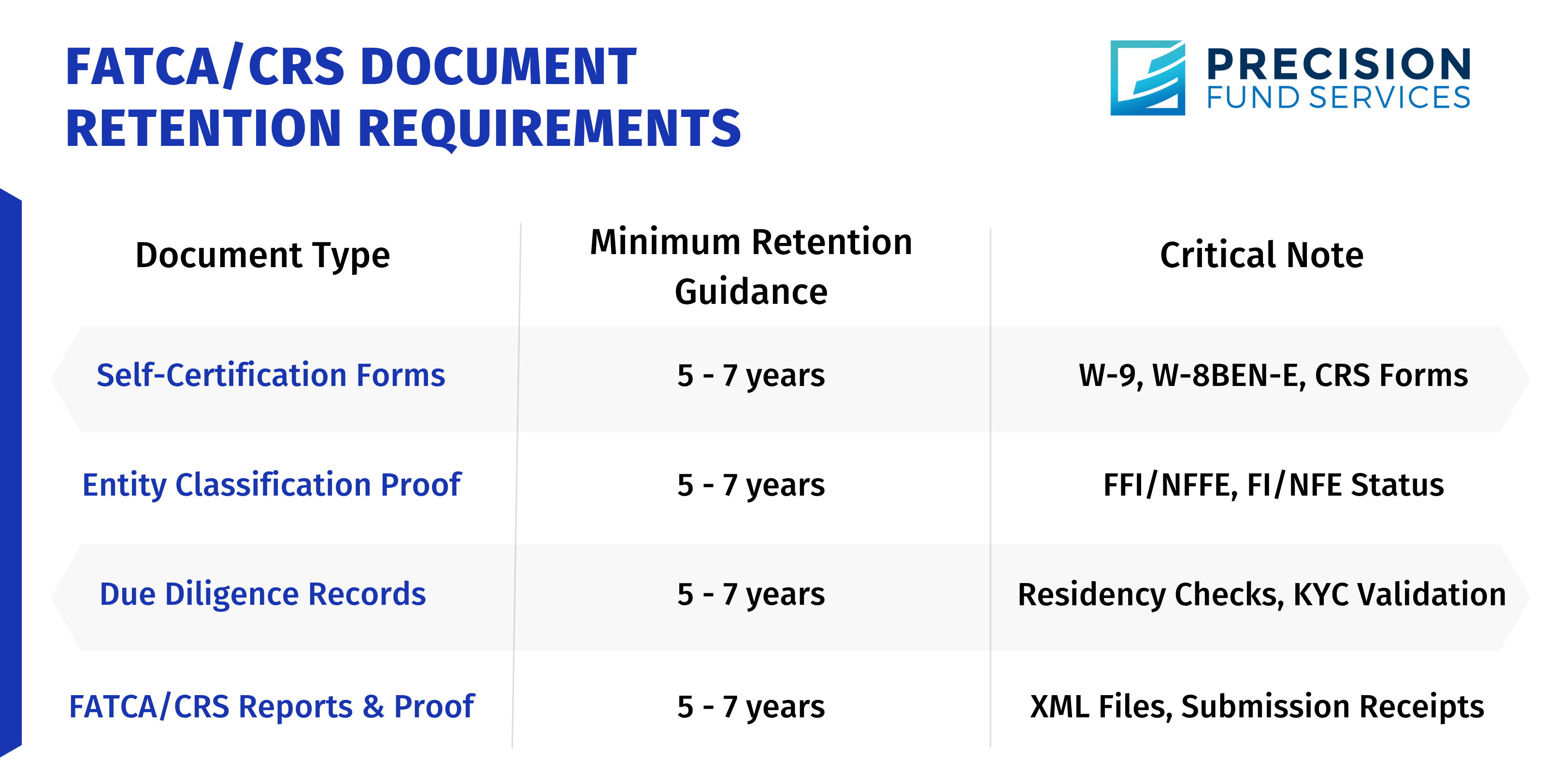

6. Documentation and Record Keeping

Maintain thorough, standardized documentation as evidence of compliance, crucial for audits or reviews.

• Essential Records: Self-certification forms, entity classification evidence, due diligence review documentation, FATCA/CRS reports, submission confirmations.

• Data Security: Implement encryption, role-based access controls, and audit logs.

• Retention Periods: Typically 5-7 years minimum, but fund’s management team must verify and comply with specific requirements in each relevant jurisdiction.

7. Policies and Procedures

Establish clear, written internal policies and procedures covering all aspects of FATCA/CRS compliance: classification, onboarding/due diligence, data management, reporting, and record keeping.

• Ensure policies align with OECD, IRS, and local tax authority requirements.

• Clearly assign roles and responsibilities for each compliance task.

• Implement a process to monitor for regulatory updates and promptly revise procedures accordingly.

8. Staff Training and Awareness

Effective compliance depends on knowledgeable staff. Provide role-specific training on FATCA/CRS requirements and internal procedures for relevant teams (compliance, operations, investor relations, IT).

• Conduct regular refresher training (e.g., annually, after regulatory changes, post-audit findings).

• Use practical examples (case studies, simulations) to enhance understanding.

• Maintain training logs as proof of ongoing competency development.

9. Audit and Internal Reviews

Regular internal reviews are vital to verify implementation effectiveness, identify gaps, and strengthen the compliance framework. They provide crucial documentation if regulators inquire.

• Conduct periodic reviews (e.g., annually or semi-annually, some FI may subject to annual attestation or certification of compliance).

• Consider involving independent internal auditors or external specialists for objectivity.

• Document findings, errors, and gaps meticulously. Implement corrective actions (e.g., procedure updates, retraining, system fixes, restatements).

• Retain a complete audit trail of reviews and remediation actions.

10. Leverage Technology for Efficiency and Accuracy

Manual processes are prone to error, delay, and oversight. Fund’s management team should evaluate and utilize appropriate technology solutions to enhance the efficiency, accuracy, and auditability of their FATCA/CRS compliance cycle.

• Technology can support: Classification validation, self-certification management, secure data/document handling, automated report generation (XML), and staying updated on regulatory changes.

• Integration: Where possible, integrate FATCA/CRS systems with core fund systems (e.g., KYC, investor registry, accounting) to ensure data consistency and streamline workflows.

Maintaining Vigilance in FATCA and CRS Compliance

FATCA and CRS compliance is an ongoing, dynamic requirement for fund’s management team with international investors. Success demands continuous vigilance, cross-functional collaboration, and a commitment to process improvement. By proactively implementing and regularly refining a structured compliance program based on these steps, fund’s management team can effectively manage regulatory risk and uphold their obligations for tax transparency.

Fund’s management team are encouraged to seek expert guidance to ensure their specific compliance framework is robust and adapts to the evolving regulatory landscape due to the fact that reporting financial institute remain fully liable for compliance, even when delegating.

Disclaimer:

This guide is shared for informational purposes only and reflects general operational practices for FATCA and CRS compliance across Hong Kong, BVI, and Cayman Islands. It does not constitute legal, tax, or regulatory advice. While every effort has been made to ensure accuracy, readers should consult their own advisors or relevant authorities for jurisdiction-specific guidance.

The fund’s management team retains full responsibility for compliance decisions and reporting obligations. We’re pleased to share this resource to support industry dialogue and best practices—feel free to repost or reference with attribution.