Feb 23, 2021

In the context of fund accounting, the "Subordinated-senior class" fee structure entails the segmentation of fund shares into distinct classes, typically denoted as "senior" and "subordinated." Investors, depending on their subscription choice, realize returns in differing orders and proportions.

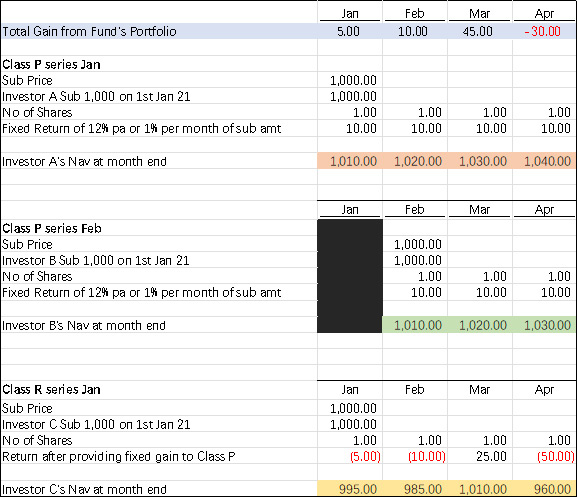

In essence, "senior" shares, exemplified by the P Class in the illustration below, do not bear the burden of fund expenses, hold priority in the allocation of fund returns (typically at a fixed rate, such as an annualized yield, e.g., 12%), and are immune to fund losses (if any). Conversely, the subordinated share (i.e., R Class, as illustrated) assumes responsibility for all fund costs (e.g., operating expenses, management fees, performance fees, etc.) and fund losses, but enjoys 100% returns beyond the "12%" annual return allotted to the "senior class." Please refer to the example below for a visual representation:

For the sake of illustration, let us assume that both "P shares" and "R shares" are valued at $1,000 per share.

1. In January, Investor A subscribed for one P share.

2. In January, Investor. C subscribed for one R share.

3. Assuming the total fund return for January is X1, then:

a) Investor. A's January return is $10 (fixed return).

b) Investor. C's return is (X1 - $10).

4. In February, a new investor, Investor B, subscribed for one P share (at this point, P shares are held by Investor B and Investor A).

5. Assuming the total fund return for February is X2, then:

a) Investor A's February return is $10.

b) Investor B’s February return is $10.

c) Investor C’s return is (X2 - $10 - $10).

It's important to note that this scenario does notconsider any fund expenses or the capital contributions ratio between both classes of shares.

For this given scenario, the appropriate performance fee calculation method would be the series method (utilizing multi-series NAV rules). This is due to the fact that only the multi-series NAV rules allow for returns allocation calculations based on each investor's corresponding shares, which may differ in terms of months and levels.

In summary, this example provides a foundational explanation of a basic "subordinated-senior class" structure from a fund accounting standpoint. It's worth mentioning that there are various other iterations not covered here. As such, fund managers are strongly advised to engage fund lawyers to articulate the fee calculation mechanism in their fund documents with precision.