Dec 29, 2020

Know Your Customer (KYC) is the process that institutions use to verify the identity of their customers and assess the likelihood of fraud, money laundering, and other risks they may pose (including identity verification, reviewing their financial activities, and assessing other risk factors). Through these processes, effective prevention of money laundering, financing terrorism, and other types of illegal financial activities is achieved.

For decades, governments worldwide have actively promoted the establishment and improvement of legislation to guide financial institutions in anti-money laundering activities. For instance, the KYC process was introduced in 2001 as part of the USA PATRIOT Act. Subsequently, in 2016, the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of the Treasury further strengthened these regulations.

On the other side of the world, the European Union (EU) introduced the General Data Protection Regulation (GDPR) in May 2018. This regulation significantly restricts the ways in which organizations can collect and manage customer data and, in turn, raises the standards and requirements for global organizations in terms of their anti-money laundering operations.

In essence, the ultimate goal of KYC is to maximize the assurance of the authenticity of a customer's identity and the probability that they are engaged in criminal activities as being "very low."

KYC Process and Compliance Requirements

KYC checks should be conducted when a financial institution is accepting someone or an entity as their customer (e.g., opening a bank account) or starting business operations with a customer (or even before that). The KYC audit consists of three core components.

Information and Data Collection

Minimum requirements include (for natural persons/institutions) customer full name, date of birth/date of establishment, (registered) address, and identity number/registration code, among other details. For institutional customers, information such as the organizational structure, executives, and beneficial owners must also be provided.

Information and Data Verification

Verification of identity based on global sanction lists and compliance databases (e.g., litigation records).

Screening for Suspicious Records

Screening for adverse records due to name matches and communicating with customers to resolve any unidentified adverse records.

What Comes After Passing KYC Verification?

Ongoing Risk Management

Although passing the initial KYC audit is a critical step, it is insufficient for mitigating risks. Throughout the entire business relationship, financial institutions must continually monitor for suspicious activities related to money laundering, terrorism financing, and other high-risk behaviors.

For example, once a customer has passed the initial KYC audit, there is no need to revalidate their identity. However, certain circumstances might warrant exceptions:

Changes in the products or services offered to the customer

Information collected previously has become outdated or no longer valid

Indications from relevant authorities that there might be money laundering suspicions in transactions

Routine Anti-Money Laundering Monitoring Includes:

Monitoring for unusual account transactions

Maintaining customer identity and institutional information, ensuring the accuracy and validity of beneficial owner information

Determining if customers are politically exposed persons (PEPs), sanctioned, or have any negative news/media coverage

Assessing whether transactions involve sensitive countries or regions

Primary Regulatory Bodies for Overseas KYC

In the United States, KYC and AML regulations (along with related Customer Due Diligence or CDD requirements) originate from the Bank Secrecy Act of 1970 and the USA PATRIOT Act of 2001. In 2016, the U.S. Treasury's FinCEN expanded the applicability of these regulations through new rules (including California's CCPA compliance regulations).

Elsewhere, the European Union, Asia-Pacific countries (APAC), and other regions have established or are in the process of developing their own compliance frameworks. In addition to the EU's General Data Protection Regulation (GDPR), the EU introduced new regulatory requirements such as the Payment Services Directive 2 (PSD2) to reduce fraud, enhance online payment security, and the 6th EU Anti-Money Laundering Directive (6AMLD). In Canada, the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) is responsible for overseeing anti-money laundering and anti-terrorist financing regulations. Moreover, dozens of countries and international organizations follow the Financial Action Task Force's compliance recommendations on enhanced due diligence for politically exposed persons and combating terrorist financing.

The Future Trends of KYC:

Traditional KYC processes might require customers to wait for days or even weeks for identity verification, but in efficient financial markets, digital KYC processes are the future trend. Digital KYC requires the following fundamental identity verification features:

Accurate extraction of data from various identity documents (e.g., passport, government-issued ID, driver's license)

Verification of the authenticity and validity of identity documents

Capture of biometric data (e.g., selfies, fingerprints) from customers

Comparison of biometric data with ID documents to verify the customer's identity

At Precision, our current digital customer KYC procedures significantly reduce the time and balance the rigor of KYC/AML processes with an efficient customer experience.

Common Anti-Money Laundering Terminologies

|

Know Your Customer (KYC) |

KYC is a process used (by a financial institution) to verify its customer identity and determine the extremely low probability of posing risks such as fraud, money laundering or financing terrorism. |

|

AML |

Money Laundering Anti-money laundering refers to the process of preventing the existence, source, movement, destination, or illegal use of the illegally obtained property or funds to make it look legal. Money laundering usually involves a three-part system: putting money into the financial system, stratifying transactions to hide the source, ownership and location of the money, and bringing it into society in forms that seem to be legally held. The definition of money-laundering varies across countries. |

|

Name Screening

|

Name screening is the process of matching the internal record (i. e. customer, client, counterparties, relevant account party) to the sanctions list record manually or through an automated screening tool. When accepting new customers, name screening is conducted according to the sanctions list and conducted in real time. |

|

Financial services regulator

|

The Financial Action Working Group(www.fatf-gafi.org)Was chartered in 1989 by the Seven Major Industrial States to facilitate the development of national and global measures against money-laundering. It is an international decision-making body that sets anti-money laundering standards and counter-terrorism financing measures around the world. |

|

Sanction List

|

A document or database that list individuals, legal entities and countries with whom it is illegal to do business with. |

|

OECD

|

The Organization for Economic Cooperation and Development (OECD) is an international organization that assists governments with solving economic development problems in the global economy. The OECD has a Financial Action Fund secretariat in Paris. |

|

GDPR(General Data Protection Regulation)

|

The General Data Protection Regulation (EU) is a regulation in the EU law on the EU (EU) and European Economic Area (EEA) data protection and privacy. It also involves data transmission of individuals outside the EU and the EEA region. The main goal of the GDPR is to protect personal privacy data and simplify the regulatory environment for international operations by unifying regulation within the EU. |

|

PSD 2

|

The European Union Payment Services Directive 2 (PSD 2) aims to better align the regulation of payments with the current state of the market and technology. PSD 2 aims to facilitate consumer access to their bank data and promote innovation by encouraging banks to securely exchange customer data with third parties. |

|

Offshore Financial Center (OFC)

|

An offshore financial center refers to the area where overseas institutions or individuals are encouraged to open banks, trading companies and other companies, funds or legal entities in a legal way, but actually operate abroad."Offshore" is mostly located in the Caribbean or Mediterranean islands, close to major financial centers in the United States and Europe. |

|

Source ofWealth |

Source of wealth (SOW) refers to the source of the client's wealth. Need to provide explanation when applying for purchase fund. |

|

Beneficial Owner

|

The term beneficial owner has two different definitions, depending on the context: Natural person who eventually owns or controls the account passed by the exchange. A natural person who has significant influence / decision-making power over an organization or an important arrangement and exercises the final and effective decision-making power. |

|

Politically Exposed Person (PEP)

|

The 40 recommedations come from FATF revised in 2012, the PEP is for individuals entrusted to hold important public positions in foreign countries, such as heads of state, senior politicians, senior government officials, judicial or military officials, senior managers of state-owned enterprises, and their families and close colleagues. |

|

Money Laundering Reporting Officer (MLRO)

|

The person responsible for overseeing the company's anti-money laundering activities and plans and for submitting reports of suspicious transactions to thefinancial services regulator.The AML Compliance Officer is a key player in implementing anti-money laundering strategies and policies. |

|

Know Your Employee (KYE)

|

Anti-money laundering policies and procedures for employees within the organization to better understand or detect employee conflicts of interest, money laundering, past criminal activities, and suspicious activities. |

Basic KYC document requirements

|

principal part |

Basic KYC document requirements |

|

Natural person |

1. Identity documents 2. Address proof 3. source of wealth |

|

Company Limited |

1. Corporate organization documents 2. And the personal KYC document of the actual controller / executive (refer to "Natural Person") |

|

Limited Partnership |

1. Organizational documents of the limited partnership 2. LPA 3. And the personal KYC document of the actual controller / executive (refer to "Natural Person") |

|

Fiduciary |

1. Regulatory document / certification of the trustee 2. Trust organization structure document 3. Client and beneficiary / actual controller (refer to "natural person") (if the trustee is not a regulated authority) |

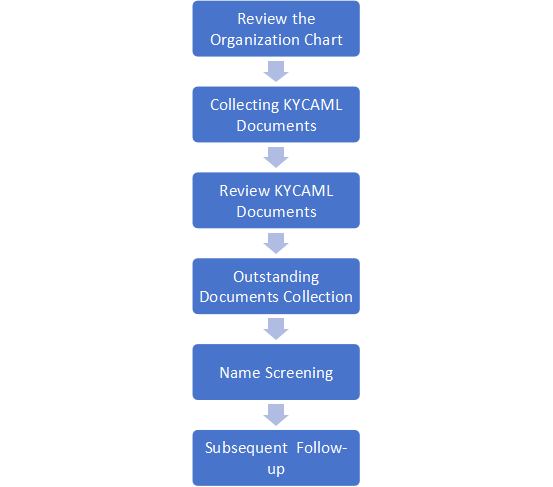

KYC Review flow chart

The below are typical 3rd party payments senarios that normally deemed as suspicious activities

|

Illustration |

|

Company A subscribed for the Fund, butthe subscription payment was from company B |

|

Company A redeemed the fund shares, but requires the redemption money to be remitted to company B |

|

Company A redeemed the fund shares but requires the redemption money to be remitted to the account of Company H |

|

Company A subscribed for the Fund, but it was paid by Ms.C |

|

The bank information filled in in Mr.A's subscription agreement is inconsistent with the actual transfer information |

|

Mr.A requested that the redemption money be remitted to another account in his name |

|

Mr.A subscribed for the Fund, but the money was remitted from theanaccount jointly owned by Mr.A and Ms.C |

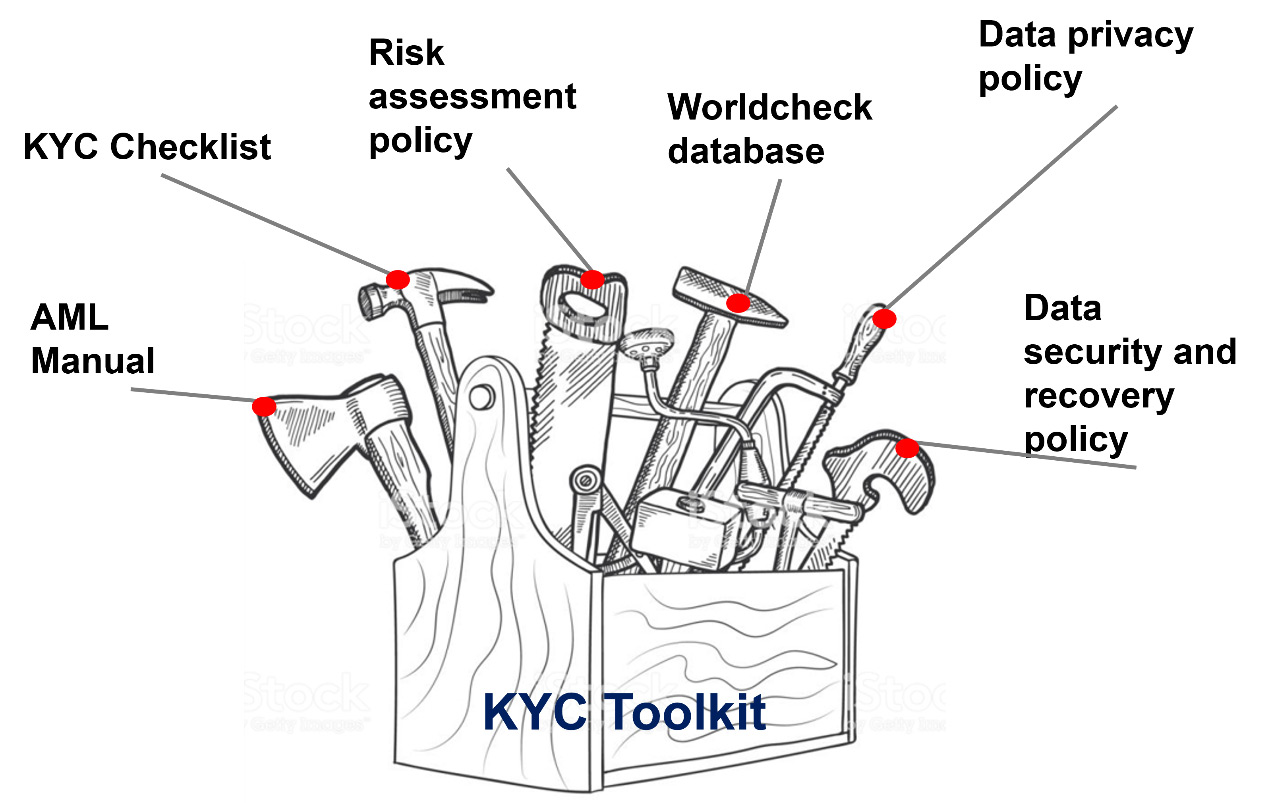

Lastly, under the increasing global anti-money laundering supervision trend, anti-money laundering and KYC have become a compulsory course for every fund practitioner. The content listed in this article can only assist readers to understand the basic framework of KYCAML, and can not be an internal guide for financial institutions. More detailed guidance should be included in the Fund and Manager / GP AML Manual (also called the AML Manual); fund managers also need their "compliance toolbox" and experienced AML compliance officers.