14 Apr 2025

In the fast-evolving world of finance, fund administration has become a cornerstone of operational efficiency, regulatory compliance, and investor trust. Whether managing hedge funds, private equity, real estate, or emerging asset classes like cryptocurrencies, fund administrators provide the infrastructure that keeps investment vehicles running smoothly. As of February 20, 2025, with markets facing heightened complexity, technological disruption, and stricter oversight, the role of fund administration is more critical than ever.

Fund administration refers to the outsourced operational backbone provided by independent third parties to investment funds. These administrators act as neutral custodians of fund integrity, delivering critical services such as net asset value (NAV) calculations, investor transaction processing, and multi-jurisdictional regulatory reporting. By maintaining rigorous accounting standards (e.g., GAAP, IFRS) and implementing robust compliance frameworks, they ensure transparency for investors while alleviating the operational burden on fund managers. Their role is particularly pivotal for alternative funds, where complex strategies—from leveraged buyouts to algorithmic crypto trading—demand specialized expertise beyond typical in-house capabilities.

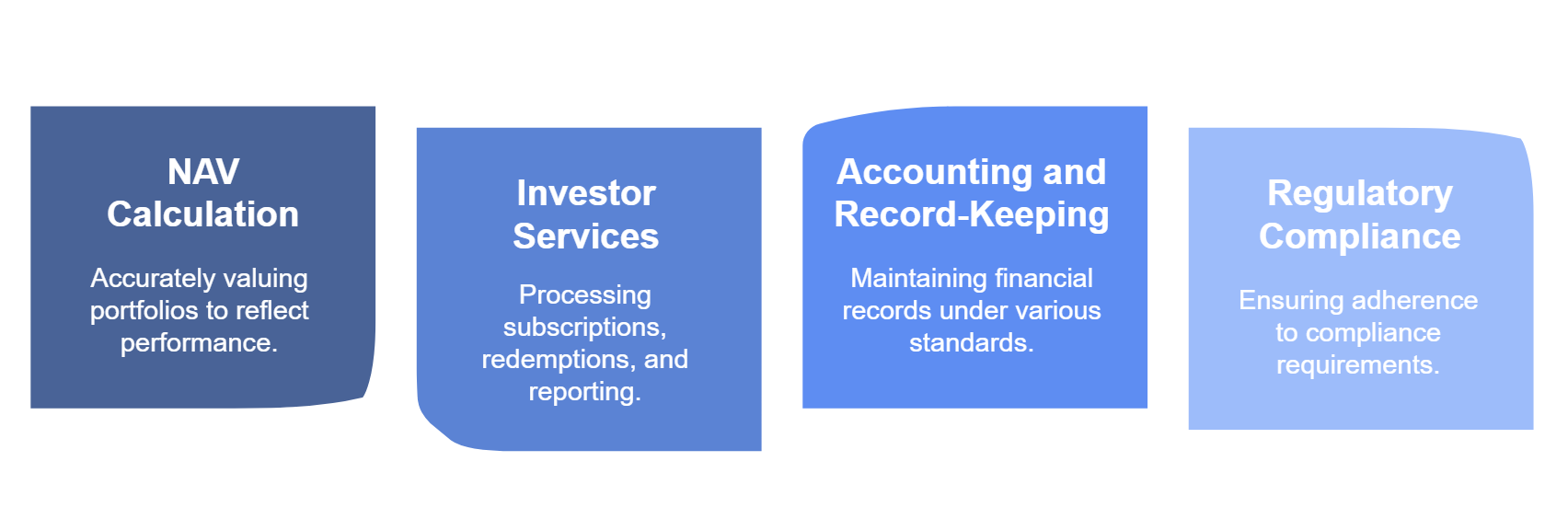

Fund administration involves a suite of services that support the operational, financial, and regulatory needs of investment funds. These include:

These functions are particularly vital for alternative investment funds, which often operate with complex strategies—such as long/short equity, distressed debt, or blockchain-based assets—requiring tailored administrative support.

The financial landscape in 2025 is shaped by transparency, diversification, volatility, technological innovation, a surge in alternative investments, and independence. Fund administration addresses several key challenges:

Investors demand the most updated and error-free data. A misstep in NAV calculation or a delay in reporting can undermine confidence and trigger outflows. Advanced tools, like encrypted investor reports or automated reconciliation systems, are now standard to ensure precision—a necessity for funds dealing with illiquid assets or multi-currency portfolios.

Global regulators are intensifying scrutiny. For instance, compliance with anti-money laundering laws often requires verifying investor identities and monitoring transactions across jurisdictions—tasks that can overwhelm in-house teams. Administrators bridge this gap by managing filings with authorities and staying abreast of evolving rules, such as those in high-growth financial hubs like Asia. This process involves not only a cutting-edge KYC/AML system but also requires expertise to identify results and information generated from the data sources. E.g., identify PEP, same name hits, etc., and further determine whether or not it needs to be escalated to AML officers or further actions for filing of any suspicious reports.

As funds expand—whether through new investors, larger AUM, or diversified strategies—manual processes become inefficient. Administrators provide scalable solutions, from streamlined investor onboarding (sometimes completed in minutes via online forms) to handling complex fund structures across regions like Cayman Islands, BVI, Hong Kong, Singapore.

The cost of implementing and maintaining an in-house fund accounting system can be prohibitive, especially for managers focused on niche strategies. These systems are designed to accommodate a full spectrum of asset classes—from equities and bonds to derivatives and digital tokens—which often exceeds the needs of a single fund. For example, a private equity fund manager specializing in mid-market buyouts would rarely utilize functionalities built for crypto staking yield calculations or real-time FX hedging. Yet, licensing such comprehensive platforms forces managers to pay for redundant features, while still requiring ongoing investments in staff training and system upgrades. Outsourcing to administrators eliminates this mismatch, granting access to tailored technology without the overhead of underutilized tools.

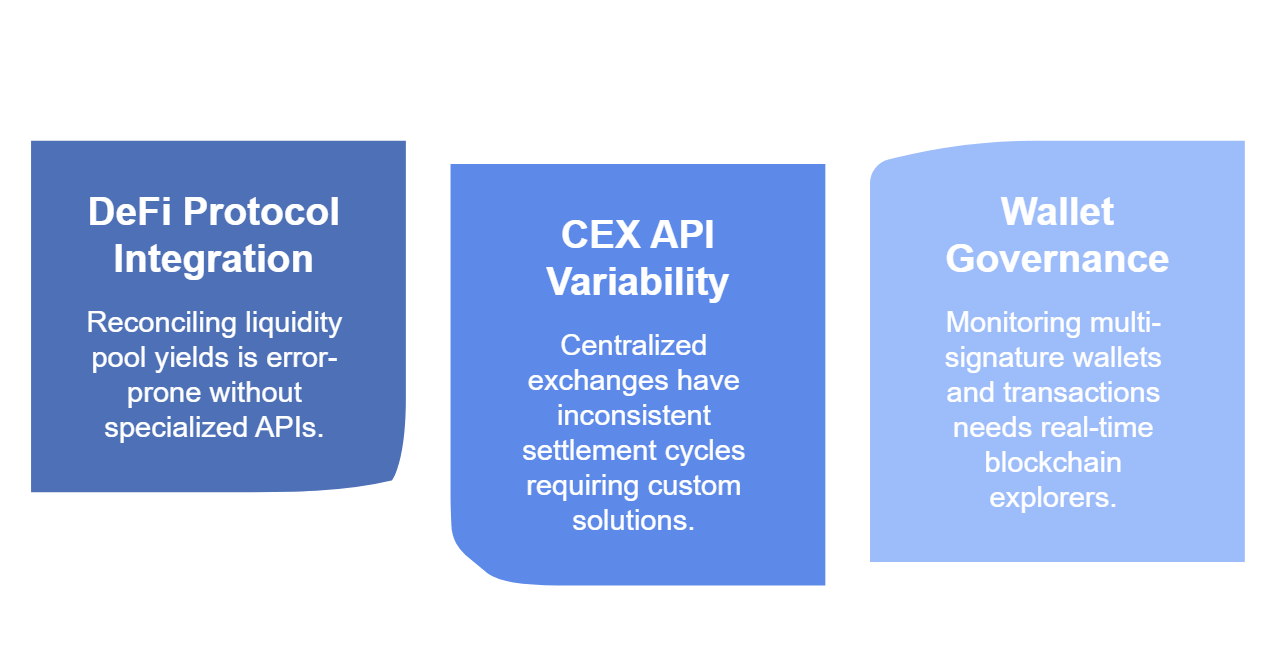

Digital assets introduce unique operational complexities due to the rapidly evolving ecosystem and lack of established market practices. Fund managers must navigate fragmented data sources, such as:

Administrators mitigate these challenges by combining modular tech stacks with deep domain knowledge, ensuring accurate reporting even as protocols and regulations shift.

The industry is undergoing a transformation driven by technology and shifting investor priorities:

These trends highlight the need for administrators to combine technical prowess with practical, hands-on experience. For instance, reviewing fund formation documents in 1-3 business days or providing HTTPS-secured portals reflects the agility and security modern funds require.

For fund managers, selecting an administrator is a strategic decision. Considerations include:

Smaller, boutique administrators often excel in flexibility and personalized service, while larger firms may offer broader resources. The choice depends on the fund’s goals and operational needs.

Fund administration operates behind the scenes, yet its impact resonates across the investment ecosystem. As markets grow more intricate, administrators ensure accuracy, compliance, and scalability—freeing managers to focus on strategy and performance. In 2025 and beyond, their role is evolving from a support function to a strategic partnership, driving efficiency and trust in an increasingly competitive landscape. For funds navigating this terrain, a capable administrator isn’t just an asset—it’s a necessity.