8 Apr 2025

Arbitrage funds, particularly those active in cryptocurrency markets, navigate a terrain of fleeting opportunities and intricate dynamics. These strategies capitalize on structural inefficiencies—such as price discrepancies or recurring payments across markets—while aiming for a market-neutral position. For fund administrators, the task is to distill this complexity into an accurate, consistent valuation that mirrors the portfolio’s financial reality. This article outlines a systematic process for valuing an arbitrage fund, informed by principles that align with insights from Keyblock Solutions, though the framework is designed as a broadly applicable guide.

The Nature of Arbitrage Strategies

Arbitrage funds thrive on market misalignment. A typical approach might involve buying a cryptocurrency like Bitcoin on an exchange where it’s undervalued, such as Binance, and selling it on another, like OKX, where it commands a premium. Alternatively, funds might pair a spot asset with a derivative, like a futures contract, to secure periodic income while neutralizing price risk. The aim is steady returns with minimal directional exposure. Understanding this interplay lays the groundwork for valuation.

Step 1: Documenting Portfolio Components

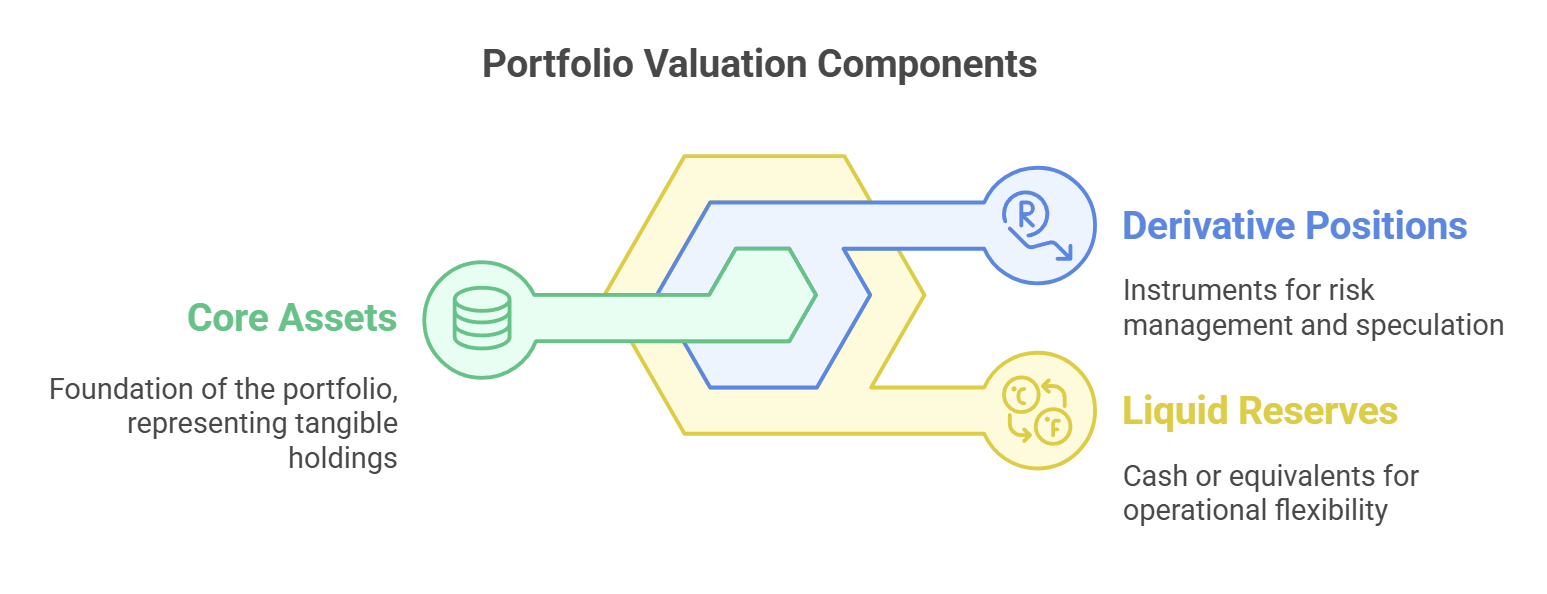

Valuation starts with a detailed inventory of the fund’s holdings:

• Core Assets: The quantity and market value of assets—digital currencies, for example—are tied to current prices from reputable exchanges.

• Derivative Positions: Futures or options are assessed for size, direction (long or short), and mark-to-market value, incorporating leverage effects.

• Liquid Reserves: Cash or equivalents, often earmarked for margin or operational needs, complete the snapshot.

Keyblock Solutions highlights a practical nuance: “If you’re trading across centralized exchanges like Binance and OKX, the fund administrator needs to integrate APIs from both to capture trades, positions, and P&L. That’s a heavier data load than a typical strategy.” This step relies on real-time feeds and precise record-keeping to ensure operational accuracy.

Step 2: Tracking Periodic Income

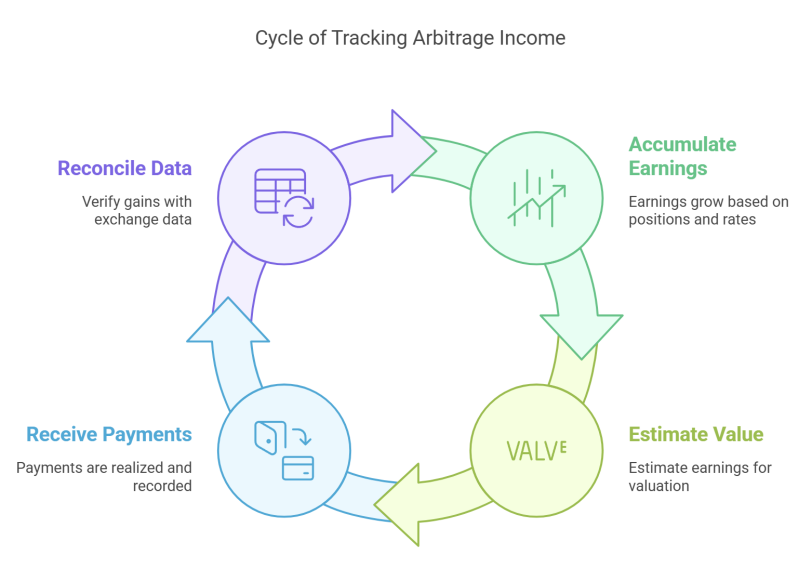

Arbitrage often depends on income streams, such as payouts from futures contracts. Capturing this requires:

• Accrued Earnings: Between payout cycles, income accumulates based on position sizes and rates, folded into the valuation as estimates.

• Realized Cash Flows: Once payments are received, they’re recorded as verified gains, reconciled with exchange data.

This dual approach reflects both potential and actual returns, complicated by the high transaction volume inherent to arbitrage. “Profit per trade is razor-thin,” Keyblock Solutions notes, “so you’re dealing with a flood of trades to build meaningful gains. That ramps up data processing demands.”

Step 3: Reconciling Hedged Positions

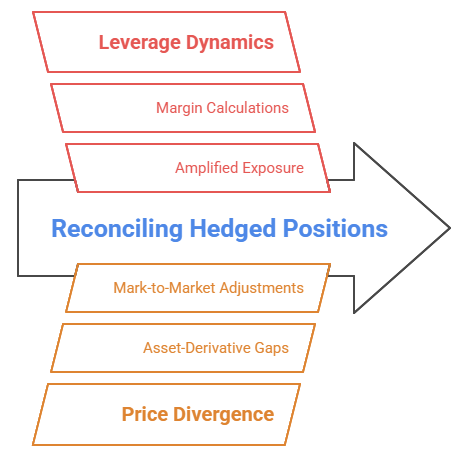

Neutrality is the goal, but perfect hedges are rare. Adjustments address:

• Leverage Dynamics: Derivatives can amplify exposure, necessitating clear calculations of net risk and margin sufficiency.

• Price Divergence: Minor gaps between asset and derivative prices generate temporary gains or losses, marked to market daily.

Monitoring these ensures the valuation aligns with the fund’s risk profile—a critical task as volatility can disrupt even well-calibrated hedges.

Step 4: Computing Net Asset Value (NAV)

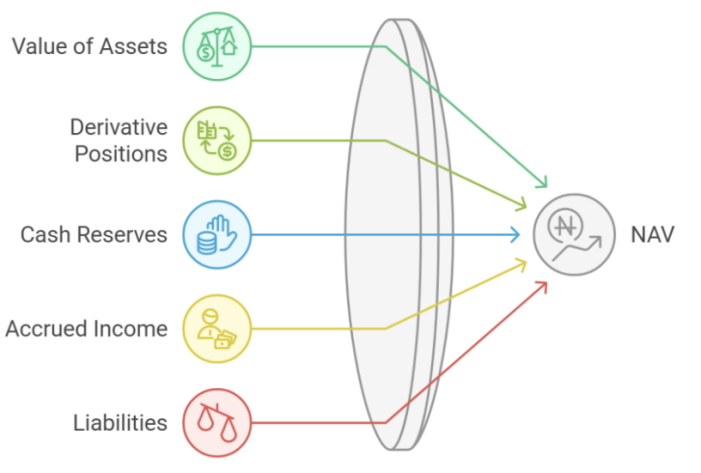

With all elements mapped, NAV takes shape:

NAV = Value of Assets + Derivative Positions + Cash Reserves + Accrued Income - Liabilities

Liabilities might include management fees, performance-based incentives, or operational costs, calculated per the fund’s terms. A time-weighted method often balances frequent capital flows, providing a fair value representation. For funds spanning multiple exchanges or jurisdictions, this demands robust systems to manage the intricacy.

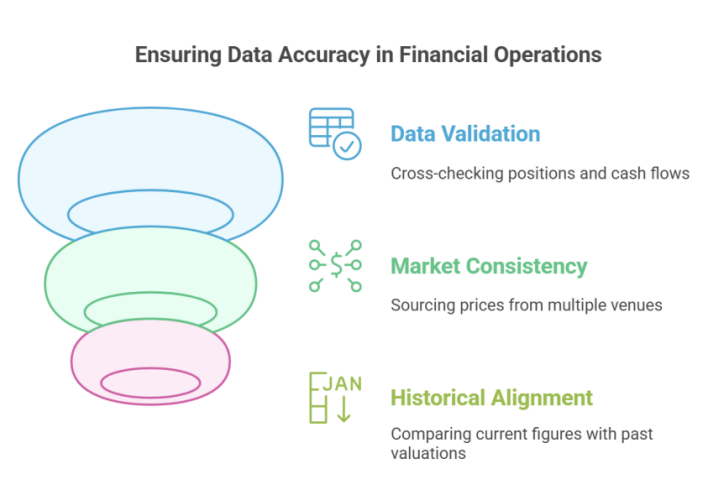

Step 5: Ensuring Accuracy

Precision is paramount. Verification involves:

• Data Validation: Positions and cash flows are cross-checked with exchange statements.

• Market Consistency: Prices are sourced from multiple venues to avoid over-reliance on a single feed.

• Historical Alignment: Current figures are compared to prior valuations to spot discrepancies.

Automation proves invaluable here, especially for high-frequency strategies. “With arbitrage, you’re swamped with data,” Keyblock Solutions observes. “Tech like automated reconciliation slashes through the clutter—hours, not days.”

Practical Considerations

Crypto arbitrage introduces unique challenges:

• Price Volatility: Rapid shifts necessitate frequent valuation updates to stay relevant.

• Platform Variability: Income mechanics—like funding rates—vary across exchanges, requiring customized adjustments.

• Decentralized Exchanges (DEXs): Keyblock Solutions adds, “If you’re arbitraging DEX-to-DEX or CEX-to-DEX, you’re pulling data from blockchain protocols—like Uniswap’s chain. That’s a technical hurdle; not every administrator can handle diverse blockchain data.”

These complexities reflect broader trends in fund administration, such as blockchain integration and real-time analytics, where adaptability is essential.

The Value of Fund Administration

Beyond the nuts and bolts, administrators deliver strategic benefits to arbitrage funds. Accurate NAV calculations foster investor confidence, particularly with novel or illiquid assets like crypto. Compliance—managing AML/KYC/KYW/KYT across jurisdictions or adapting to emerging digital asset regulations—draws on their expertise. Scalability is another boon: as trade volumes surge, manual processes falter, and administrators deploy technology—from API integrations to secure, encrypted reporting portals—to keep up. Assist crypto fund managers in achieving efficient operations.