17 March 2025

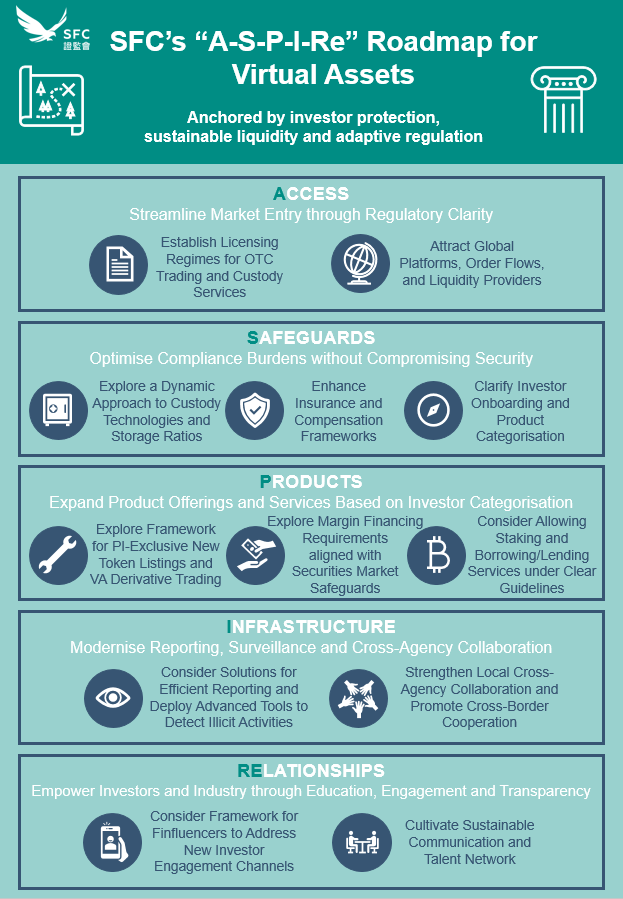

On February 19, 2025, the Securities and Futures Commission (SFC) of Hong Kong launched its "A-S-P-I-Re Roadmap," a strategic framework to advance the city’s virtual asset (VA) market. Detailed in an official SFC press release, the roadmap introduces 12 initiatives across five pillars—Access, Safeguards, Products, Infrastructure, and Relationships—to harness the potential of a global VA market valued at over US$3 trillion in 2024, with annual trading volumes exceeding US$70 trillion. For digital asset fund administrators, this development highlights our critical role in supporting the growth of regulated VA funds while ensuring compliance and operational integrity in a dynamic landscape.

Image Source: Hong Kong Securities and Futures Commission (SFC)

A Growing Ecosystem and the Role of Fund Administration

The SFC’s roadmap emphasizes expanding market access and VA product offerings, reflecting a surge in demand for regulated cryptocurrency investment vehicles. This aligns with the global trend of growing institutional and retail participation in VAs. Fund administrators play an essential role in this ecosystem by managing tasks such as reconciling blockchain-based transactions, calculating net asset values (NAV), and providing transparent investor reporting—functions rooted in industry practices for digital asset funds. These capabilities enable fund managers to innovate while meeting the SFC’s regulatory expectations.

Custody and Compliance: Pillars of Trust

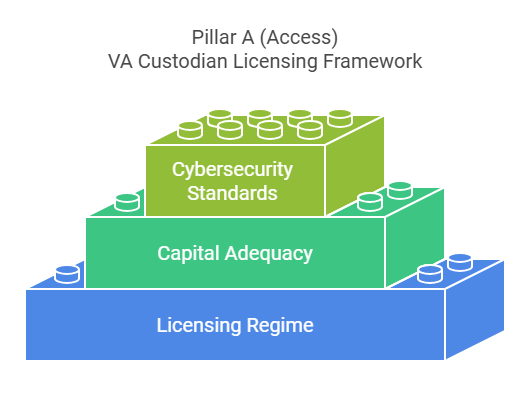

Under Pillar A (Access), the SFC plans to establish a licensing regime for VA custodians, with progress anticipated by the end of 2025, as noted in industry interpretations of the SFC’s timeline. This initiative, outlined in the SFC’s announcement, will enforce standards such as capital adequacy and cybersecurity. For fund administrators, this strengthens our collaboration with custodians to integrate these protections into fund operations, enhancing investor confidence.

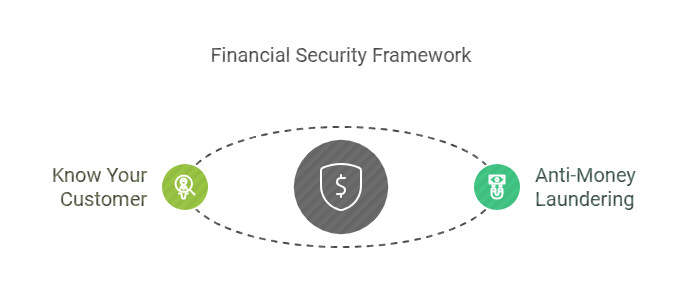

Pillar S (Safeguards) introduces a risk-based oversight model, requiring us to adapt compliance processes—such as anti-money laundering (AML) and know-your-customer (KYC) protocols—to the unique risks of digital assets. This balanced approach ensures investor protection without stifling innovation, a priority we’re well-equipped to address.

Technology as a Cornerstone

Pillar I (Infrastructure) focuses on modernizing market infrastructure with technologies like automated reporting and blockchain analytics, as highlighted in the SFC’s roadmap. For fund administrators, this aligns with our use of real-time data tools to streamline NAV calculations and transaction monitoring. By leveraging these technologies, which are standard in the industry, we can deliver actionable insights to fund managers and investors, supporting Hong Kong’s goal of integrating blockchain efficiency with the reliability of traditional finance.

Building Relationships and Educating Stakeholders

The Relationships pillar (Pillar Re) emphasizes collaboration and investor education, areas where fund administrators contribute by providing clear reporting and addressing investor inquiries. This role, informed by general fund administration expertise, supports the SFC’s vision of a trusted VA market, enhancing transparency and engagement across stakeholders.

This can be reflected in the daily fund admin operations where the fund admin will disclose the fund performance to fund investors, LPs upon approval of the fund director or GP.

Positioning for the Future

The SFC’s roadmap positions Hong Kong as a competitive VA hub, distinct from jurisdictions like the EU or the U.S., by offering an investor-centric framework. For fund administrators, this presents an opportunity to support global clients entering this market, particularly as regulatory shifts—such as custody and OTC trading frameworks—progress by year-end. By refining our processes proactively, we ensure readiness for these changes.

We are seeing more and more crypto natives are coming back to HK to explore opportunities to operate their VA businesses, including licensing, cooperating VA licensed platform to launch regulated investment funds. Also,Trad FI guys are actively converting their expertise to VA space, e.g. increasing portfolio allocation to digital assets, building relationship with vendors or participants in crypto space, more institutions are becoming more crypto friendly to support the development of digital asset industry in the region.

Conclusion

The SFC’s A-S-P-I-Re Roadmap, announced on February 19, 2025, marks a significant step toward strengthening Hong Kong’s VA ecosystem. For digital asset fund administrators, it underscores our role in bridging innovation and regulation, ensuring operational excellence and investor trust as Hong Kong aims to lead the global VA economy.

we are working with 2 digits of full VA licensed asset managers and their lawyers, custodian and banks closely, and will continue explore mutual oppo to grow with along with this momentum.

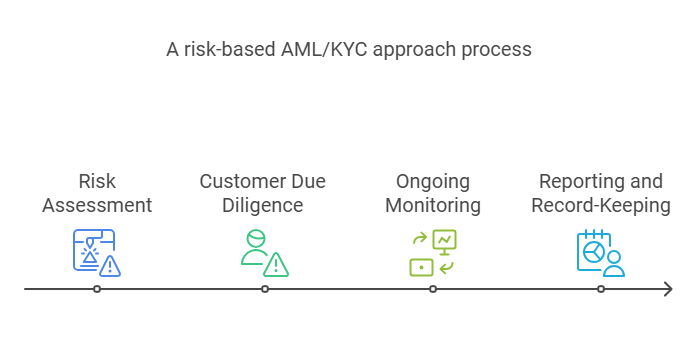

What is a risk-based approach?

Risk-Based AML/KYC Approach

A risk-based AML/KYC approach involves tailoring due diligence and monitoring efforts based on the assessed risk level of a client or transaction. Here’s how it works:

1. Risk Assessment

Evaluate the risk level of the client, product, and jurisdiction:

• Client Risk: Background, occupation, political exposure, etc

• Product Risk: Complexity and nature of the financial product (e.g., hedge funds vs. mutual funds).

• Geographic Risk: Risk associated with the client’s jurisdiction (e.g., high-risk countries).

2. Customer Due Diligence (CDD)

Apply the appropriate level of due diligence based on the risk assessment:

• Simplified Due Diligence (SDD): For low-risk clients.

• Standard Due Diligence: For moderate-risk clients.

• Enhanced Due Diligence (EDD): For high-risk clients (e.g., PEPs, high-risk jurisdictions).

3. Ongoing Monitoring

Continuously monitor client transactions and behavior:

• Transaction Monitoring: Detect unusual patterns (e.g., sudden large transfers).

• Periodic Reviews: Reassess the client’s risk profile regularly.

4. Reporting and Record-Keeping

Maintain detailed records and report suspicious activities:

• Documentation: Keep records of all due diligence and monitoring efforts.

• Suspicious Activity Reports (SARs): File reports with authorities if suspicious activities are detected.

Example Scenario

A fund administrator onboarding a politically exposed person (PEP) from a high-risk jurisdiction:

1. Risk Assessment: High risk (PEP + private equity fund + high-risk jurisdiction).

2. CDD: Enhanced Due Diligence (EDD) – verify source of wealth, identify beneficial owners.

3. Ongoing Monitoring: Daily transaction monitoring and quarterly reviews.

4. Reporting: Document findings and file SARs if suspicious activities are detected.

This approach ensures compliance with regulatory requirements while efficiently managing risks. It is a common practice adopted by fund administrators, including alternative fund administrators, to align with industry standards.